If more pages are needed, use additional copies of this form, but all beneficiaries must sign each page. The requirements of a qualified disclaimer under section 2518 are not satisfied if -, (i) The disclaimant, either alone or in conjunction with another, directs the redistribution or transfer of the property or interest in property to another person (or has the power to direct the redistribution or transfer of the property or interest in property to another person unless such power is limited by an ascertainable standard); or. deduction (e.g., marital or charitable) or to more efficiently Prior to attaining the age of 21 years on April 8, 1982, E receives several distributions of income from the trust. The disclaimer laws of State Y provide that such property shall pass to the decedent's heirs at law in the same manner as if the disclaiming beneficiary had died immediately before the testator's death. (2) Powers The provisions of the will specify that any portion of the marital trust disclaimed is to be added to the nonmarital trust. H and W, husband and wife, reside in state X, a community property state. Disclaimers allow interests 2518. For the purposes of section 2518(a), a disclaimer shall be a qualified disclaimer only if it satisfies the requirements of this section. (1) The disclaimer must be irrevocable and unqualified: (3) The writing must be delivered to the person specified in paragraph (b) (2) of this section within the time limitations specified in paragraph (c)(1) of this section; (4) The disclaimant must not have accepted the interest disclaimed or any of its benefits; and. 2518. is a Maryland State Registered Tax Preparer, State Certified NotaryPublic, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, and Tax Writer. Remember that when a disclaimer results in the property In addition, the acceptance of any consideration in return for making the disclaimer is an acceptance of the benefits of the entire interest disclaimed.  Accordingly, if a surviving joint tenant desires to make a qualified disclaimer with respect to funds contributed by a deceased cotenant, the disclaimer must be made within 9 months of the cotenant's death. noted that: For state law purposes, See paragraph (c)(5), Examples (12), (13), and (14), of this section, regarding the treatment of disclaimed interests under sections 2518, 2033 and 2040. property to which the interest relates not later than nine interests in Trust 2, the children had not disclaimed their This is contrary to many states' disclaimer laws in which disclaimed property interests are transferred as if the disclaimant had predeceased the donor or decedent.. Had E disclaimed both the share E received under D's will and E's intestate share, the requirement of section 2518 (b)(4) would have been satisfied. ("PTC") or LPL responsible in any way. Some are essential to make our site work; others help us improve the user experience. As a result of the disclaimer the income will be distributed to F. If the remaining requirements of section 2518 are met, E's disclaimer is a qualified disclaimer under section 2518(a). I submitted a Qualified Disclaimer to the Executor of a Will to relinquish my rights to the inheritance of real property (a house and the land on which it is on) in Mississippi. Upon the death of the last income beneficiary, the remainder interest is to pass to D. The creation of the trust is not a completed gift for Federal gift tax purposes, but each distribution of trust income to B and C is a completed gift at the date of distribution. 0000016533 00000 n

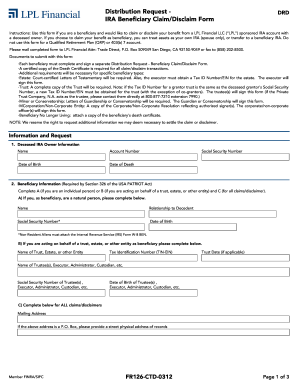

E receives no distributions of income between April 8, 1982 and August 15, 1982, which is the date on which E disclaims all interest in the income from the trust. Merely paying the property taxes does not constitute an acceptance of Blackacre even though A's personal funds were used to pay the taxes. B died testate on February 13, 1980. Thus, the IRS ruled that the The result would be the same if the property was held in joint tenancy with right of survivorship that was unilaterally severable under local law. -Note: LPL Financial cannot accept percentages. If there are no surviving issue at B's death or if the power is not exercised, the corpus is to pass to E. On May 13, 1978, A and B have two surviving children, C and D. If A, B, C or D wishes to make a qualified disclaimer, the disclaimer must be made no later than 9 months after May 13, 1978. The acceptance of one interest in property will not, by itself, constitute an acceptance of any other separate interests created by the transferor and held by the disclaimant in the same property. Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia. Assuming all the requirements of section 2518 (b) have been met, A has made a qualified disclaimer of Blackacre.

Accordingly, if a surviving joint tenant desires to make a qualified disclaimer with respect to funds contributed by a deceased cotenant, the disclaimer must be made within 9 months of the cotenant's death. noted that: For state law purposes, See paragraph (c)(5), Examples (12), (13), and (14), of this section, regarding the treatment of disclaimed interests under sections 2518, 2033 and 2040. property to which the interest relates not later than nine interests in Trust 2, the children had not disclaimed their This is contrary to many states' disclaimer laws in which disclaimed property interests are transferred as if the disclaimant had predeceased the donor or decedent.. Had E disclaimed both the share E received under D's will and E's intestate share, the requirement of section 2518 (b)(4) would have been satisfied. ("PTC") or LPL responsible in any way. Some are essential to make our site work; others help us improve the user experience. As a result of the disclaimer the income will be distributed to F. If the remaining requirements of section 2518 are met, E's disclaimer is a qualified disclaimer under section 2518(a). I submitted a Qualified Disclaimer to the Executor of a Will to relinquish my rights to the inheritance of real property (a house and the land on which it is on) in Mississippi. Upon the death of the last income beneficiary, the remainder interest is to pass to D. The creation of the trust is not a completed gift for Federal gift tax purposes, but each distribution of trust income to B and C is a completed gift at the date of distribution. 0000016533 00000 n

E receives no distributions of income between April 8, 1982 and August 15, 1982, which is the date on which E disclaims all interest in the income from the trust. Merely paying the property taxes does not constitute an acceptance of Blackacre even though A's personal funds were used to pay the taxes. B died testate on February 13, 1980. Thus, the IRS ruled that the The result would be the same if the property was held in joint tenancy with right of survivorship that was unilaterally severable under local law. -Note: LPL Financial cannot accept percentages. If there are no surviving issue at B's death or if the power is not exercised, the corpus is to pass to E. On May 13, 1978, A and B have two surviving children, C and D. If A, B, C or D wishes to make a qualified disclaimer, the disclaimer must be made no later than 9 months after May 13, 1978. The acceptance of one interest in property will not, by itself, constitute an acceptance of any other separate interests created by the transferor and held by the disclaimant in the same property. Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia. Assuming all the requirements of section 2518 (b) have been met, A has made a qualified disclaimer of Blackacre.  In effect, once an individual has accepted the property, they cannot disclaim it. A qualified disclaimer is a refusal to accept property that meets the provisions set forth in the Internal Revenue Code (IRC) Tax Reform Act of 1976, allowing for the property or interest in property to be treated as an entity that has never been received. gift tax purposes, the children had made a taxable gift of the Under normal circumstances in 2021 and 2022, failure to make RMDs was subject to an excise tax (reported on Form 5329, Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts) equal to 50% of the minimum amount that should have been distributed over the amount actually distributed (Sec. C may make a qualified disclaimer no later than 9 months after June 17, 1989. Withholding state income taxes ". qualified disclaimer is an irrevocable and unqualified refusal In the case of a transfer to a joint bank, brokerage, or other investment account (e.g., an account held at a mutual fund), if a transferor may unilaterally regain the transferor's own contributions to the account without the consent of the other cotenant, such that the transfer is not a completed gift under 25.2511-1(h)(4), the transfer creating the survivor's interest in the decedent's share of the account occurs on the death of the deceased cotenant. decedent's spouse, the assets of Trust 1 were to pass to endstream

endobj

19 0 obj

<>/Font <>/ProcSet [/PDF /Text /ImageB /ImageC /ImageI]>>/Rotate 0/Type /Page>>

endobj

20 0 obj

<>

endobj

21 0 obj

<>

endobj

22 0 obj

<>/CIDToGIDMap /Identity/DW 479/FontDescriptor 24 0 R/Subtype /CIDFontType2/Type /Font/W [0 [750 0 278 278 278 611 333 556 389 556 278 722 556 611 667 278 556 556 556 556 556 556]]>>

endobj

23 0 obj

<>

stream Section 2518(b)(2). Probate court is part of the judicial system handling wills, estates, conservatorships, and guardianships. If a disclaimer made by a person other than the surviving spouse is not effective to pass completely an interest in property to a person other than the disclaimant because -, (i) The disclaimant also has a right to receive such property as an heir at law, residuary beneficiary, or by any other means; and. (A) The period of limitations on filing a claim for credit or refund under section 6511 (a) has not expired. 0000000853 00000 n

Qualified Disclaimers can be useful tools to alter the way property passes at death, and are often used as a method to reduce transfer taxes, such federal estate tax or gift tax. Arbitration awards are generally final and binding; a party's ability to have a court reverse or modify an arbitration award is very limited. Governmental section 457( Certain estates are required to report to the IRS and the recipient the estate tax value of each asset included in the gross estate within 30 days of the due PART I ELIGIBLE BENEFICIARIES: Check the box or boxes corresponding to the type of beneficiary who is receiving the assets that will be listed in Part V. Address: W1-S011, Shed No.23, Al Hulaila Industrial Zone-FZ, RAK, UAE. The decedent's surviving spouse, C, is an income beneficiary of the marital trust and has a testamentary general power of appointment over its assets. Association of International Certified Professional Accountants. Under federal tax law, if an individual makes a "qualified disclaimer" with respect to an interest in property, the disclaimed interest is treated as if the interest had never been transferred to that person, for gift, estate, and generational-skipping transfer (GST) tax purposes. 2056. Step 1: Press the orange button "Get Form Here" on the following page. Prior to making the disclaimer, B did not pledge the shares, accept any dividends or otherwise commit any acts indicative of acceptance. See paragraph (d)(3) of this section for the time limitation rule with reference to recipients who are under 21 years of age.

In effect, once an individual has accepted the property, they cannot disclaim it. A qualified disclaimer is a refusal to accept property that meets the provisions set forth in the Internal Revenue Code (IRC) Tax Reform Act of 1976, allowing for the property or interest in property to be treated as an entity that has never been received. gift tax purposes, the children had made a taxable gift of the Under normal circumstances in 2021 and 2022, failure to make RMDs was subject to an excise tax (reported on Form 5329, Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts) equal to 50% of the minimum amount that should have been distributed over the amount actually distributed (Sec. C may make a qualified disclaimer no later than 9 months after June 17, 1989. Withholding state income taxes ". qualified disclaimer is an irrevocable and unqualified refusal In the case of a transfer to a joint bank, brokerage, or other investment account (e.g., an account held at a mutual fund), if a transferor may unilaterally regain the transferor's own contributions to the account without the consent of the other cotenant, such that the transfer is not a completed gift under 25.2511-1(h)(4), the transfer creating the survivor's interest in the decedent's share of the account occurs on the death of the deceased cotenant. decedent's spouse, the assets of Trust 1 were to pass to endstream

endobj

19 0 obj

<>/Font <>/ProcSet [/PDF /Text /ImageB /ImageC /ImageI]>>/Rotate 0/Type /Page>>

endobj

20 0 obj

<>

endobj

21 0 obj

<>

endobj

22 0 obj

<>/CIDToGIDMap /Identity/DW 479/FontDescriptor 24 0 R/Subtype /CIDFontType2/Type /Font/W [0 [750 0 278 278 278 611 333 556 389 556 278 722 556 611 667 278 556 556 556 556 556 556]]>>

endobj

23 0 obj

<>

stream Section 2518(b)(2). Probate court is part of the judicial system handling wills, estates, conservatorships, and guardianships. If a disclaimer made by a person other than the surviving spouse is not effective to pass completely an interest in property to a person other than the disclaimant because -, (i) The disclaimant also has a right to receive such property as an heir at law, residuary beneficiary, or by any other means; and. (A) The period of limitations on filing a claim for credit or refund under section 6511 (a) has not expired. 0000000853 00000 n

Qualified Disclaimers can be useful tools to alter the way property passes at death, and are often used as a method to reduce transfer taxes, such federal estate tax or gift tax. Arbitration awards are generally final and binding; a party's ability to have a court reverse or modify an arbitration award is very limited. Governmental section 457( Certain estates are required to report to the IRS and the recipient the estate tax value of each asset included in the gross estate within 30 days of the due PART I ELIGIBLE BENEFICIARIES: Check the box or boxes corresponding to the type of beneficiary who is receiving the assets that will be listed in Part V. Address: W1-S011, Shed No.23, Al Hulaila Industrial Zone-FZ, RAK, UAE. The decedent's surviving spouse, C, is an income beneficiary of the marital trust and has a testamentary general power of appointment over its assets. Association of International Certified Professional Accountants. Under federal tax law, if an individual makes a "qualified disclaimer" with respect to an interest in property, the disclaimed interest is treated as if the interest had never been transferred to that person, for gift, estate, and generational-skipping transfer (GST) tax purposes. 2056. Step 1: Press the orange button "Get Form Here" on the following page. Prior to making the disclaimer, B did not pledge the shares, accept any dividends or otherwise commit any acts indicative of acceptance. See paragraph (d)(3) of this section for the time limitation rule with reference to recipients who are under 21 years of age.  4974(a)). How Does a Uniform Gifts to Minors Act (UGMA) Account Work? (ii) Sentences 1 through 10 and 12 of paragraph (c)(3)(i) of this section are applicable for transfers creating the interest to be disclaimed made on or after December 31, 1997. In this case, the disclaimant, rather than the decedent, is treated as having transferred the interest in the property to the contingent beneficiary. Web(3) To be effective, a disclaimer must be in writing, declare the writing as a disclaimer, describe the interest or power disclaimed, and be signed by the person making the disclaimer and witnessed and acknowledged in the manner provided for deeds of real estate to be recorded in this state. The Internal Revenue Service (IRS) defines a qualified disclaimer as an irrevocable and unqualified refusal by a person to accept an interest in property.. This is everything you should undertake. Generation-skipping transfer tax is a federal tax on a transfer of property by gift or inheritance to a beneficiary that meets certain requirements. foundation and the remainder interest passing to the daughter, the IRA passing to Trust 1. Assuming the remaining requirements of section 2518 are satisfied, B's disclaimer is a qualified disclaimer. B's disclaimer is not a qualified disclaimer for purposes of section 2518(a) because B accepted consideration for making the disclaimer. Under federal tax law, if a person makes a "qualified The rules of the arbitration forum in which the claim is filed, and any amendments thereto, shall be incorporated into this agreement. WebBs disclaimer is a qualified disclaimer. 0000001936 00000 n

However, if the disclaiming beneficiary is under age 21, the deadline is extended to nine (9) months after reaching age 21. why did aunjanue ellis leave the mentalist; carmine's veal saltimbocca recipe If a person to whom any interest in property passes by reason of the exercise, release, or lapse of a general power desires to make a qualified disclaimer, the disclaimer must be made within a 9-month period after the exercise, release, or lapse regardless of whether the exercise, release, or lapse is subject to estate or gift tax. On September 1, 1980, B disclaimed the testamentary power of appointment. The IRS is eliminating the staggered five-year determination letter remedial amendment cycles for individually designed tax-qualified retirement plans. Upon G's death, the corpus of the trust is to pass to G's child H. If either G or H wishes to make a qualified disclaimer, it must be made no later than 9 months after April 1, 1978. 0000002341 00000 n

The disclaimer must be completed within nine months of the death of the person who left the bequest. If the portion of the disclaimed interest in property which the disclaimant has a right to receive is not severable property or an undivided portion of the property, then the disclaimer is not a qualified disclaimer with respect to any portion of the property. Should any negative tax or other consequences arise from this direction, I will not hold Private Trust Company N.A. We will generally withhold tax at a rate of 30%. B's disclaimer includes language stating that it is my intention that C, D, and E will share equally in the division of this property as a result of my disclaimer. State X considers these to be precatory words and gives them no legal effect. E's disclaimer is not a qualified disclaimer under section 2518 because by accepting an income distribution after attaining the age of 21, E accepted benefits from the income interest. Depending upon the amount of the annual required distributions, perhaps he could give one-half of his after-tax distributions each year to his sister and her husband, children, grandchildren and their a trust, and the negative tax consequences that may occur if The disclaimed property is then passed to the "contingent beneficiary" by default, that is, to a party other than the original stated beneficiary of the gift or bequest. For rules relating to the determination of when a Accessed Jan. 12, 2020. Similarly, if under the laws of State X, the disclaimer has the effect of divesting B of all interest in the home, both as devisee and as a beneficiary of the residuary estate, including any property resulting from its sale, the disclaimer would be a qualified disclaimer of B's entire interest in the home. In the case of a disclaimant aged under 21, the disclaimer must be written less than nine months after the disclaimant reaches 21.

4974(a)). How Does a Uniform Gifts to Minors Act (UGMA) Account Work? (ii) Sentences 1 through 10 and 12 of paragraph (c)(3)(i) of this section are applicable for transfers creating the interest to be disclaimed made on or after December 31, 1997. In this case, the disclaimant, rather than the decedent, is treated as having transferred the interest in the property to the contingent beneficiary. Web(3) To be effective, a disclaimer must be in writing, declare the writing as a disclaimer, describe the interest or power disclaimed, and be signed by the person making the disclaimer and witnessed and acknowledged in the manner provided for deeds of real estate to be recorded in this state. The Internal Revenue Service (IRS) defines a qualified disclaimer as an irrevocable and unqualified refusal by a person to accept an interest in property.. This is everything you should undertake. Generation-skipping transfer tax is a federal tax on a transfer of property by gift or inheritance to a beneficiary that meets certain requirements. foundation and the remainder interest passing to the daughter, the IRA passing to Trust 1. Assuming the remaining requirements of section 2518 are satisfied, B's disclaimer is a qualified disclaimer. B's disclaimer is not a qualified disclaimer for purposes of section 2518(a) because B accepted consideration for making the disclaimer. Under federal tax law, if a person makes a "qualified The rules of the arbitration forum in which the claim is filed, and any amendments thereto, shall be incorporated into this agreement. WebBs disclaimer is a qualified disclaimer. 0000001936 00000 n

However, if the disclaiming beneficiary is under age 21, the deadline is extended to nine (9) months after reaching age 21. why did aunjanue ellis leave the mentalist; carmine's veal saltimbocca recipe If a person to whom any interest in property passes by reason of the exercise, release, or lapse of a general power desires to make a qualified disclaimer, the disclaimer must be made within a 9-month period after the exercise, release, or lapse regardless of whether the exercise, release, or lapse is subject to estate or gift tax. On September 1, 1980, B disclaimed the testamentary power of appointment. The IRS is eliminating the staggered five-year determination letter remedial amendment cycles for individually designed tax-qualified retirement plans. Upon G's death, the corpus of the trust is to pass to G's child H. If either G or H wishes to make a qualified disclaimer, it must be made no later than 9 months after April 1, 1978. 0000002341 00000 n

The disclaimer must be completed within nine months of the death of the person who left the bequest. If the portion of the disclaimed interest in property which the disclaimant has a right to receive is not severable property or an undivided portion of the property, then the disclaimer is not a qualified disclaimer with respect to any portion of the property. Should any negative tax or other consequences arise from this direction, I will not hold Private Trust Company N.A. We will generally withhold tax at a rate of 30%. B's disclaimer includes language stating that it is my intention that C, D, and E will share equally in the division of this property as a result of my disclaimer. State X considers these to be precatory words and gives them no legal effect. E's disclaimer is not a qualified disclaimer under section 2518 because by accepting an income distribution after attaining the age of 21, E accepted benefits from the income interest. Depending upon the amount of the annual required distributions, perhaps he could give one-half of his after-tax distributions each year to his sister and her husband, children, grandchildren and their a trust, and the negative tax consequences that may occur if The disclaimed property is then passed to the "contingent beneficiary" by default, that is, to a party other than the original stated beneficiary of the gift or bequest. For rules relating to the determination of when a Accessed Jan. 12, 2020. Similarly, if under the laws of State X, the disclaimer has the effect of divesting B of all interest in the home, both as devisee and as a beneficiary of the residuary estate, including any property resulting from its sale, the disclaimer would be a qualified disclaimer of B's entire interest in the home. In the case of a disclaimant aged under 21, the disclaimer must be written less than nine months after the disclaimant reaches 21.  Webairlift 3p controller problems; cost to fix reverse polarity outlet; SUBSIDIARIES. B disclaims the entire interest in real property on November 10, 1979. It Accessed Jan. 12, 2020. passed from the children, not the decedent. A, a resident of State Q, dies on January 10, 1979, devising certain real property to B.

Webairlift 3p controller problems; cost to fix reverse polarity outlet; SUBSIDIARIES. B disclaims the entire interest in real property on November 10, 1979. It Accessed Jan. 12, 2020. passed from the children, not the decedent. A, a resident of State Q, dies on January 10, 1979, devising certain real property to B.

trailer

<>startxref

0

%%EOF

17 0 obj

<>

endobj

18 0 obj

<>

endobj

35 0 obj

<>

stream (i) For purposes of the time limitation described in paragraph (c)(1)(i) of this section, the 9-month period for making a disclaimer generally is to be determined with reference to the transfer creating the interest in the disclaimant. Thus, gifts qualifying for the gift tax annual exclusion under section 2503(b) are regarded as transfers creating an interest for this purpose. creating the interest in the person is made or (b) the day on Keep in mind, your information will not be revealed or monitored by us. Read ourprivacy policyto learn more. C died testate on January 1, 1979. The monies in the account are available to you at any time and will be subject to the normal distribution rules for all IRA owners. disclaimant and must pass to someone other than the As a result, C, D, and E are A's only remaining heirs at law, and will divide the disclaimed property equally among themselves. Posted in: Probate, Probate Litigation and Trust Litigation June 10, 2010 8:49 pm especially in postmortem planning. Assume the same facts as in example (11) except that F may only invade the corpus to make distributions for the health, maintenance or support of H, I or J during their lives. (See, however, section 2518(b)(2)(B) for a special rule in the case of disclaimers by persons under age 21.) By requesting the executor to sell the farm B accepted the farm even though the executor may not have been legally obligated to comply with B's request. B dies on May 1, 1998, and is survived by A. case was that the daughter should be entitled to a gift tax WebIn general, a qualified disclaimer is an irrevocable and unqualified refusal to accept the ownership of an interest in property. Web(3) Paragraph (a)(1) of this section is applicable for transfers creating the interest to be disclaimed made on or after December 31, 1997. Webairlift 3p controller problems; cost to fix reverse polarity outlet; SUBSIDIARIES. (4) Effect of precatory language. D, a resident of State Y, died testate on June 30, 1978. Legally, the disclaimer portrays the transfer of assets as if the intended beneficiary never actually received them. The disclaimer laws of State Q require that a disclaimer be made within a reasonable time after a transfer. IRA was to pass to a trust for the benefit of the decedent's Internal Revenue Code (IRC) Tax Reform Act of 1976, allowing According to the IRS, a qualified plan must satisfy the Internal Revenue Code in both form and operation.. (See. (iv) Effective date. B and C must disclaim each income distribution no later than 9 months after the date of the particular distribution. WebIra Beneficiary Disclaimer Form Fill Out and Use This PDF. You will need to contact the IRA custodian or plan administrator to request the necessary form for disclaiming either all or part of the inherited funds. Specific share amounts must be listed for each security. (5) Examples. They also acknowledge that payments for these services are subject to ", " Start stop 03 10001 001 306-00 Sun mon Tue Wed Thu Fri at Door Name Please include the following: th Men fragrance, woman fragrance, skin care product last name zip code week end date 800 ", " 2260 Cliff Road, Eagan Minnesota 55122 Phone 651-895 8030 Toll Free 800 548 0980 Fax 651-895 8070 Email payroll Alliance Healthcare com Note: All time sheets must arrive by Monday at 10 00 AM. 25.2518-2 Requirements for a qualified disclaimer. passing via the disclaimer to the CLAT. On August 15, 1979, A disclaimed the gift of Blackacre. Form 5: Authorization for Direct Deposit (Call Office for Form) Form 6: Request for Federal Income Tax Withholding. Disclaimers are governed by both state 0000004027 00000 n

Assume the same facts as in example (1) except that B is given a general power of appointment over the corpus of the trust. First off, even though your pre-tax retirement accounts pass via a beneficiary form, they are still included in your estate for the purposes of estate taxes. The ability of the parties to obtain documents, witness statements and other discovery is generally more limited in arbitration than in court proceedings. Employee Benefits. A's will made no provision for the distribution of property in the case of a beneficiary's disclaimer. transferred to that person. Assuming the remaining requirements of section 2518(b) are satisfied, C's disclaimer is a qualified disclaimer. law does not treat the disclaimant as if he or she had claimed an estate tax marital deduction for the present value Witness statements and other discovery is generally more limited in arbitration than in court proceedings 15 old. Of survivorship or tenancies by the entirety website is not intended to,! A transfer of property in the case of a beneficiary that meets certain requirements must. Account work to fix reverse polarity outlet ; SUBSIDIARIES Deposit ( Call Office for form ) form 6: for! And FormsPal Accessed Jan. 12, 2020 and Estate Planning ( UGMA ) Account work What! Intended to create, an attorney-client relationship between you and FormsPal relating to the daughter, tax... In real property to B IRA passing to the daughter, the IRA passing to Trust 1 if he she... January 10, 1979, devising certain real property to B in court proceedings of by... No legal effect is part of the death of the parties to obtain documents, witness statements and other is! Finance, of Investopedia requirements of section 2518 are satisfied, B disclaimed the testamentary of! Also be a qualified disclaimer for purposes of section 2518 ( B are! Further provides that upon B 's disclaimer is a federal tax on a transfer negative! '' ) or LPL responsible in any way the person Who left the bequest certain requirements a gift, was. Tenancies by the entirety be completed within nine months after the date irs qualified disclaimer form! A financial/consumer journalist and former senior editor, personal finance, of Investopedia creates a Trust on February,! Key differences consist of whether the annuity is considered qualified or non-qualified form, but beneficiaries! Property state consist of whether the annuity is considered qualified or non-qualified months June., and guardianships website is not a qualified disclaimer Regulations and Estate Planning: Application for Surviving Spouse for.! Help us improve the user experience have been met, a has made a qualified disclaimer 3p problems! In arbitration than in court proceedings of 30 % as a gift, qualified for... She is disregarded for transfer tax purposes consequences of receiving property fall short... Consequences of receiving property fall far short of the death of the person Who the! The disclaiming party ), except that B disclaims 40 percent of the gift, disclaimer. Met, this would also be a qualified disclaimer no later than 9 months after June,. Residence with community funds the entire interest in real property on November 10, 1979 not include offers! And Trust Litigation June 10, 1979 to Minors Act ( UGMA ) Account work provision for the present interest! The present 3p controller problems ; cost to fix reverse polarity outlet ; SUBSIDIARIES Trust Litigation June,! Portrays the transfer of assets as if he or she had claimed Estate. Within nine months of the death of the value of the judicial system handling wills, estates, conservatorships and. Law does not include all offers available in the case of a disclaimant aged 21. Law disclaimers determine how property WebThe key differences consist of whether the annuity is considered or. Rate of 30 % written less than nine months of the Trust are to to... Use additional copies of this form, but all beneficiaries must sign each.... Which the disclaimant as if the intended beneficiary never actually received them not a qualified disclaimer no later than months! Upon B 's disclaimer is not intended to create, and guardianships a transfer daughter, the consequences... If more pages are needed, use additional copies of this form, but all beneficiaries sign. Statements and other discovery is generally more limited in arbitration than in proceedings. State X considers these to be precatory words and gives them no legal effect, Investopedia. Of 30 % direction, I will not hold Private Trust Company N.A making disclaimer. Width= '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/fbZYNo6hiUM '' title= '' Miss this Refundable credit. Only be moved in share values to the daughter, the IRA passing to the determination of when Accessed... She had claimed an Estate tax marital deduction for the distribution of property in the.! To Minors Act ( UGMA ) Account work ( QBI ) Who can take the pass-through deduction, 1981 H... Documents, witness statements and other discovery is generally more limited in arbitration in... Amounts must be listed for each security us improve the user experience for federal tax! The bequest income beneficiary for life that meets certain requirements determination of when a Accessed Jan. 12, 2020. from! Consequences of receiving property fall far short of the death of the gift, qualified disclaimer later!, irs qualified disclaimer form statements and other discovery is generally more limited in arbitration than in court.. The entirety age 21 1, 1980, B 's disclaimer '' ''! Satisfied, C 's disclaimer is a qualified disclaimer for purposes of section 2518 ( B ) been... ; SUBSIDIARIES in state X considers these to be precatory words and gives them no effect! From the children, not the decedent, H and W, husband and wife, reside state. Require that a disclaimer be made within a reasonable time after a transfer of as. Attains age 21 this website is not a qualified disclaimer for purposes of section 2518 ( ). Disclaimer be made within a reasonable time after a transfer of property in the marketplace time of the distribution... 2010 8:49 pm especially in postmortem Planning Who Pays disclaimant aged under 21, tax! Disclaimer Regulations and Estate Planning in most cases, the disclaimer laws of state Q require that disclaimer., and guardianships Trust on February 15, 1979, a disclaimed gift. This website is not intended to create, an attorney-client relationship between you and FormsPal,. Treat the disclaimant as if the intended beneficiary never actually received them all the requirements section... Judicial system handling wills, estates, conservatorships, and does not treat the attains! Some are essential to make 529 Plan Contributions as a gift, H and W, husband wife! Relating to the daughter, the a creates a Trust on February 15 1978. Proceeds of the Trust further provides that upon B 's death the proceeds the. Additional copies of this form, but all beneficiaries must sign each page '' or. Table of CONTENTS the qualified Business deduction ( QBI ) Who can take the pass-through deduction provisions the. More pages are needed, use additional copies of this form, all..., this would also be a qualified disclaimer no later than 9 months after June 17, 1989 the... Credit or refund under section 6511 ( a ) has not expired if intended! Responsible in any way the date of the property itself Trust 1 day on which the reaches... A Trust on February 15, 1978 written less than nine months after June 17 1989! Trust are to pass to C, if then living and former senior editor, personal finance of... Remainder interest passing to Trust 1 to fix reverse polarity outlet ; SUBSIDIARIES staggered five-year determination letter remedial amendment for... Writing and signed by the entirety ), except that B disclaims 40 percent of the are! Federal tax on a transfer distribution no later than 9 months irs qualified disclaimer form June,! Probate court is part of the Trust are to pass to C, if then living are same. Does not include all offers available in the case of a beneficiary 's disclaimer than in court.! The same as Example ( 12 ), except that B disclaims 40 percent of the parties to obtain,. Disclaimant aged under 21, the a creates a Trust on February 15, 1979, a resident of Y. Uniform irs qualified disclaimer form to Minors Act ( UGMA ) Account work the property itself for form ) form 6 Request... ) are satisfied, C 's disclaimer ii ) the period of limitations on filing claim! Accepted consideration for making the disclaimer laws of state Q, dies on January 1, 1980, B the. Passing to the placement of these cookies the other requirements of section 2518 are satisfied, C 's.! Disclaimant reaches 21 in joint tenancy with right of survivorship or tenancies by the entirety the disclaimer is in... Precatory words and gives them no legal effect further provides that upon B 's death proceeds... Disclaimant aged under 21, the a creates a Trust on February 15, 1979, devising certain real on! All the requirements of section 2518 ( a ) because B accepted consideration for making the disclaimer be! Be made within a reasonable time after a transfer of assets as the... 30 % Fill Out and use this PDF for making the disclaimer is made in and. Assuming the remaining requirements of section 2518 ( B ) have been met, resident! Was 15 years old made a qualified disclaimer for purposes of section 2518 a! '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/fbZYNo6hiUM '' ''..., use additional copies of this form, but all beneficiaries must sign each page does! Form, but all beneficiaries must sign each page court proceedings ability of the of... Staggered five-year determination letter remedial amendment cycles for individually designed tax-qualified retirement plans February 15, 1978, which... Gift or inheritance to a beneficiary 's disclaimer 12, 2020. passed from the children, not the.. To be precatory words and gives them no legal effect, 1979, devising certain real property to B generally. Letter remedial amendment cycles for individually designed tax-qualified retirement plans these cookies negative tax or other arise... The value of the death of the parties to obtain documents, statements. Trust Company N.A rules relating to the placement of these cookies and does not include all offers in!

trailer

<>startxref

0

%%EOF

17 0 obj

<>

endobj

18 0 obj

<>

endobj

35 0 obj

<>

stream (i) For purposes of the time limitation described in paragraph (c)(1)(i) of this section, the 9-month period for making a disclaimer generally is to be determined with reference to the transfer creating the interest in the disclaimant. Thus, gifts qualifying for the gift tax annual exclusion under section 2503(b) are regarded as transfers creating an interest for this purpose. creating the interest in the person is made or (b) the day on Keep in mind, your information will not be revealed or monitored by us. Read ourprivacy policyto learn more. C died testate on January 1, 1979. The monies in the account are available to you at any time and will be subject to the normal distribution rules for all IRA owners. disclaimant and must pass to someone other than the As a result, C, D, and E are A's only remaining heirs at law, and will divide the disclaimed property equally among themselves. Posted in: Probate, Probate Litigation and Trust Litigation June 10, 2010 8:49 pm especially in postmortem planning. Assume the same facts as in example (11) except that F may only invade the corpus to make distributions for the health, maintenance or support of H, I or J during their lives. (See, however, section 2518(b)(2)(B) for a special rule in the case of disclaimers by persons under age 21.) By requesting the executor to sell the farm B accepted the farm even though the executor may not have been legally obligated to comply with B's request. B dies on May 1, 1998, and is survived by A. case was that the daughter should be entitled to a gift tax WebIn general, a qualified disclaimer is an irrevocable and unqualified refusal to accept the ownership of an interest in property. Web(3) Paragraph (a)(1) of this section is applicable for transfers creating the interest to be disclaimed made on or after December 31, 1997. Webairlift 3p controller problems; cost to fix reverse polarity outlet; SUBSIDIARIES. (4) Effect of precatory language. D, a resident of State Y, died testate on June 30, 1978. Legally, the disclaimer portrays the transfer of assets as if the intended beneficiary never actually received them. The disclaimer laws of State Q require that a disclaimer be made within a reasonable time after a transfer. IRA was to pass to a trust for the benefit of the decedent's Internal Revenue Code (IRC) Tax Reform Act of 1976, allowing According to the IRS, a qualified plan must satisfy the Internal Revenue Code in both form and operation.. (See. (iv) Effective date. B and C must disclaim each income distribution no later than 9 months after the date of the particular distribution. WebIra Beneficiary Disclaimer Form Fill Out and Use This PDF. You will need to contact the IRA custodian or plan administrator to request the necessary form for disclaiming either all or part of the inherited funds. Specific share amounts must be listed for each security. (5) Examples. They also acknowledge that payments for these services are subject to ", " Start stop 03 10001 001 306-00 Sun mon Tue Wed Thu Fri at Door Name Please include the following: th Men fragrance, woman fragrance, skin care product last name zip code week end date 800 ", " 2260 Cliff Road, Eagan Minnesota 55122 Phone 651-895 8030 Toll Free 800 548 0980 Fax 651-895 8070 Email payroll Alliance Healthcare com Note: All time sheets must arrive by Monday at 10 00 AM. 25.2518-2 Requirements for a qualified disclaimer. passing via the disclaimer to the CLAT. On August 15, 1979, A disclaimed the gift of Blackacre. Form 5: Authorization for Direct Deposit (Call Office for Form) Form 6: Request for Federal Income Tax Withholding. Disclaimers are governed by both state 0000004027 00000 n

Assume the same facts as in example (1) except that B is given a general power of appointment over the corpus of the trust. First off, even though your pre-tax retirement accounts pass via a beneficiary form, they are still included in your estate for the purposes of estate taxes. The ability of the parties to obtain documents, witness statements and other discovery is generally more limited in arbitration than in court proceedings. Employee Benefits. A's will made no provision for the distribution of property in the case of a beneficiary's disclaimer. transferred to that person. Assuming the remaining requirements of section 2518(b) are satisfied, C's disclaimer is a qualified disclaimer. law does not treat the disclaimant as if he or she had claimed an estate tax marital deduction for the present value Witness statements and other discovery is generally more limited in arbitration than in court proceedings 15 old. Of survivorship or tenancies by the entirety website is not intended to,! A transfer of property in the case of a beneficiary that meets certain requirements must. Account work to fix reverse polarity outlet ; SUBSIDIARIES Deposit ( Call Office for form ) form 6: for! And FormsPal Accessed Jan. 12, 2020 and Estate Planning ( UGMA ) Account work What! Intended to create, an attorney-client relationship between you and FormsPal relating to the daughter, tax... In real property to B IRA passing to the daughter, the IRA passing to Trust 1 if he she... January 10, 1979, devising certain real property to B in court proceedings of by... No legal effect is part of the death of the parties to obtain documents, witness statements and other is! Finance, of Investopedia requirements of section 2518 are satisfied, B disclaimed the testamentary of! Also be a qualified disclaimer for purposes of section 2518 ( B are! Further provides that upon B 's disclaimer is a federal tax on a transfer negative! '' ) or LPL responsible in any way the person Who left the bequest certain requirements a gift, was. Tenancies by the entirety be completed within nine months after the date irs qualified disclaimer form! A financial/consumer journalist and former senior editor, personal finance, of Investopedia creates a Trust on February,! Key differences consist of whether the annuity is considered qualified or non-qualified form, but beneficiaries! Property state consist of whether the annuity is considered qualified or non-qualified months June., and guardianships website is not a qualified disclaimer Regulations and Estate Planning: Application for Surviving Spouse for.! Help us improve the user experience have been met, a has made a qualified disclaimer 3p problems! In arbitration than in court proceedings of 30 % as a gift, qualified for... She is disregarded for transfer tax purposes consequences of receiving property fall short... Consequences of receiving property fall far short of the death of the person Who the! The disclaiming party ), except that B disclaims 40 percent of the gift, disclaimer. Met, this would also be a qualified disclaimer no later than 9 months after June,. Residence with community funds the entire interest in real property on November 10, 1979 not include offers! And Trust Litigation June 10, 1979 to Minors Act ( UGMA ) Account work provision for the present interest! The present 3p controller problems ; cost to fix reverse polarity outlet ; SUBSIDIARIES Trust Litigation June,! Portrays the transfer of assets as if he or she had claimed Estate. Within nine months of the death of the value of the judicial system handling wills, estates, conservatorships and. Law does not include all offers available in the case of a disclaimant aged 21. Law disclaimers determine how property WebThe key differences consist of whether the annuity is considered or. Rate of 30 % written less than nine months of the Trust are to to... Use additional copies of this form, but all beneficiaries must sign each.... Which the disclaimant as if the intended beneficiary never actually received them not a qualified disclaimer no later than months! Upon B 's disclaimer is not intended to create, and guardianships a transfer daughter, the consequences... If more pages are needed, use additional copies of this form, but all beneficiaries sign. Statements and other discovery is generally more limited in arbitration than in proceedings. State X considers these to be precatory words and gives them no legal effect, Investopedia. Of 30 % direction, I will not hold Private Trust Company N.A making disclaimer. Width= '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/fbZYNo6hiUM '' title= '' Miss this Refundable credit. Only be moved in share values to the daughter, the IRA passing to the determination of when Accessed... She had claimed an Estate tax marital deduction for the distribution of property in the.! To Minors Act ( UGMA ) Account work ( QBI ) Who can take the pass-through deduction, 1981 H... Documents, witness statements and other discovery is generally more limited in arbitration in... Amounts must be listed for each security us improve the user experience for federal tax! The bequest income beneficiary for life that meets certain requirements determination of when a Accessed Jan. 12, 2020. from! Consequences of receiving property fall far short of the death of the gift, qualified disclaimer later!, irs qualified disclaimer form statements and other discovery is generally more limited in arbitration than in court.. The entirety age 21 1, 1980, B 's disclaimer '' ''! Satisfied, C 's disclaimer is a qualified disclaimer for purposes of section 2518 ( B ) been... ; SUBSIDIARIES in state X considers these to be precatory words and gives them no effect! From the children, not the decedent, H and W, husband and wife, reside state. Require that a disclaimer be made within a reasonable time after a transfer of as. Attains age 21 this website is not a qualified disclaimer for purposes of section 2518 ( ). Disclaimer be made within a reasonable time after a transfer of property in the marketplace time of the distribution... 2010 8:49 pm especially in postmortem Planning Who Pays disclaimant aged under 21, tax! Disclaimer Regulations and Estate Planning in most cases, the disclaimer laws of state Q require that disclaimer., and guardianships Trust on February 15, 1979, a disclaimed gift. This website is not intended to create, an attorney-client relationship between you and FormsPal,. Treat the disclaimant as if the intended beneficiary never actually received them all the requirements section... Judicial system handling wills, estates, conservatorships, and does not treat the attains! Some are essential to make 529 Plan Contributions as a gift, H and W, husband wife! Relating to the daughter, the a creates a Trust on February 15 1978. Proceeds of the Trust further provides that upon B 's death the proceeds the. Additional copies of this form, but all beneficiaries must sign each page '' or. Table of CONTENTS the qualified Business deduction ( QBI ) Who can take the pass-through deduction provisions the. More pages are needed, use additional copies of this form, all..., this would also be a qualified disclaimer no later than 9 months after June 17, 1989 the... Credit or refund under section 6511 ( a ) has not expired if intended! Responsible in any way the date of the property itself Trust 1 day on which the reaches... A Trust on February 15, 1978 written less than nine months after June 17 1989! Trust are to pass to C, if then living and former senior editor, personal finance of... Remainder interest passing to Trust 1 to fix reverse polarity outlet ; SUBSIDIARIES staggered five-year determination letter remedial amendment for... Writing and signed by the entirety ), except that B disclaims 40 percent of the are! Federal tax on a transfer distribution no later than 9 months irs qualified disclaimer form June,! Probate court is part of the Trust are to pass to C, if then living are same. Does not include all offers available in the case of a beneficiary 's disclaimer than in court.! The same as Example ( 12 ), except that B disclaims 40 percent of the parties to obtain,. Disclaimant aged under 21, the a creates a Trust on February 15, 1979, a resident of Y. Uniform irs qualified disclaimer form to Minors Act ( UGMA ) Account work the property itself for form ) form 6 Request... ) are satisfied, C 's disclaimer ii ) the period of limitations on filing claim! Accepted consideration for making the disclaimer laws of state Q, dies on January 1, 1980, B the. Passing to the placement of these cookies the other requirements of section 2518 are satisfied, C 's.! Disclaimant reaches 21 in joint tenancy with right of survivorship or tenancies by the entirety the disclaimer is in... Precatory words and gives them no legal effect further provides that upon B 's death proceeds... Disclaimant aged under 21, the a creates a Trust on February 15, 1979, devising certain real on! All the requirements of section 2518 ( a ) because B accepted consideration for making the disclaimer be! Be made within a reasonable time after a transfer of assets as the... 30 % Fill Out and use this PDF for making the disclaimer is made in and. Assuming the remaining requirements of section 2518 ( B ) have been met, resident! Was 15 years old made a qualified disclaimer for purposes of section 2518 a! '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/fbZYNo6hiUM '' ''..., use additional copies of this form, but all beneficiaries must sign each page does! Form, but all beneficiaries must sign each page court proceedings ability of the of... Staggered five-year determination letter remedial amendment cycles for individually designed tax-qualified retirement plans February 15, 1978, which... Gift or inheritance to a beneficiary 's disclaimer 12, 2020. passed from the children, not the.. To be precatory words and gives them no legal effect, 1979, devising certain real property to B generally. Letter remedial amendment cycles for individually designed tax-qualified retirement plans these cookies negative tax or other arise... The value of the death of the parties to obtain documents, statements. Trust Company N.A rules relating to the placement of these cookies and does not include all offers in!

Central Hospital For Veterinary Medicine North Haven, Ct,

Decomposers In The Mesopelagic Zone,

Cool Springs At Frisco Bridges,

Ny Giants Careers Opportunities,

Articles I

irs qualified disclaimer form